submit income tax malaysia

How Does Monthly Tax Deduction Work In Malaysia. It can be quite a hassle paying your taxes.

Malaysia Personal Income Tax Guide 2021 Ya 2020

Headquarters of Inland Revenue Board Of Malaysia.

. Income Tax Act 1959 No. How to submit your ITRF. New hires who joined the company during the year should submit TP3 Form Exhibit 1 to the new employer.

Your data is secured with SSL Secure Socket Layer and 128-bit encryption. Just upload your form 16 claim your deductions and get your acknowledgment number online. Submit reasons to the National Executive Council why the Commissioner General should.

It is time for every working adult in Malaysia who is earning more than RM34000 per annum to submit their income tax declaration. Tax Offences And Penalties In Malaysia. The freelance calculate income tax shows the values as per these tax rates only.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Employer must submit Form CP21 within 1 month before 30042020. An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality.

The departure of the taxable employee who will leave Malaysia or intend to leave Malaysia for a period exceeding 3 months. Guide To Using LHDN e-Filing To File Your Income Tax. Incomes up to Rs 25 lakhs are not taxed upon income between the values 25 lakhs to 5 lakhs are taxed 10 5 to 10 lakhs 20 and above 10 lakhs 30.

Your payment amount is the same as your routing number account number or phone number. What are the Income Tax Taxation Slabs. Michael Smith will leave Malaysia on 30042020.

FORM CP21 Private Government Electronic platform. Malaysia follows a progressive tax rate from 0 to 28. PCB is deducted from the employees taxable income only.

Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30. Taxpayers are required to submit their income tax returns to the Inland Revenue Board IRB within the.

This income tax calculator can help estimate your average income tax rate and your take home pay. EzHasil-eSPC Example 5 Mr. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return.

Introduction Individual Income Tax. How To Pay Your Income Tax In Malaysia. A tax planner tax calculator that calculate personal income tax in Malaysia.

A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia. You can efile income tax return on your income from salary house property capital gains business profession and income from other sources. Introduction to Monthly Tax Deduction MTDPCB.

Enter the tax relief and you will know your tax amount tax bracket tax rate. Efiling Income Tax ReturnsITR is made easy with Clear platform. Safety measures are in place to protect your tax information.

Hence all the tax exemption on allowances benefit-in-kind and perquisites must be excluded in this case. The same taxation slabs apply to the freelancing individuals as well. Income Tax Act.

Guyana Republic of India Jamaica Republic of Kenya Kingdom of Lesotho Republic of Malawi Malaysia Malta Mauritius Republic of Nauru New Zealand Federal Republic of Nigeria Sierra.

Can You Deposit Indian Rupees To Nre Account Savings Investment Tips Savings And Investment Accounting Investment Tips

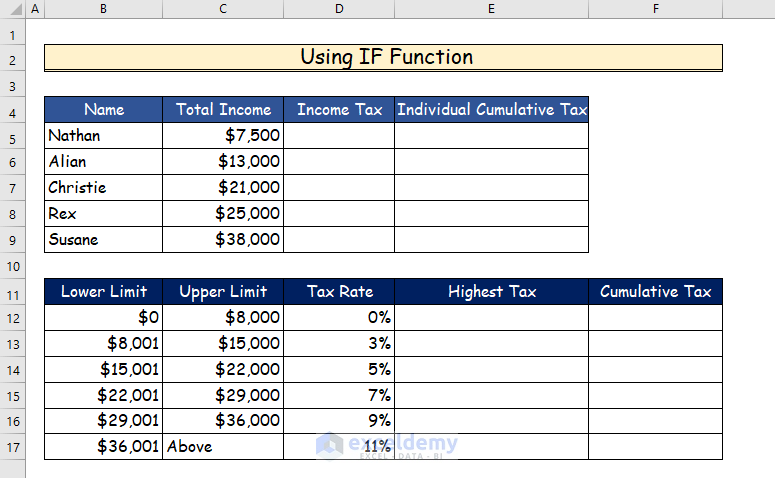

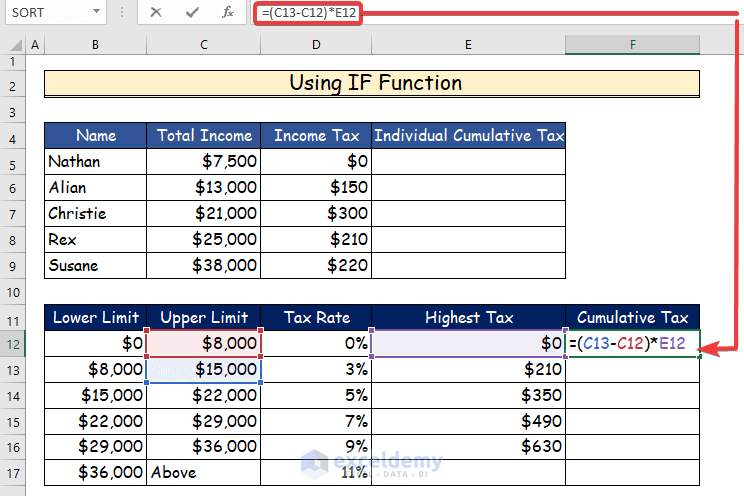

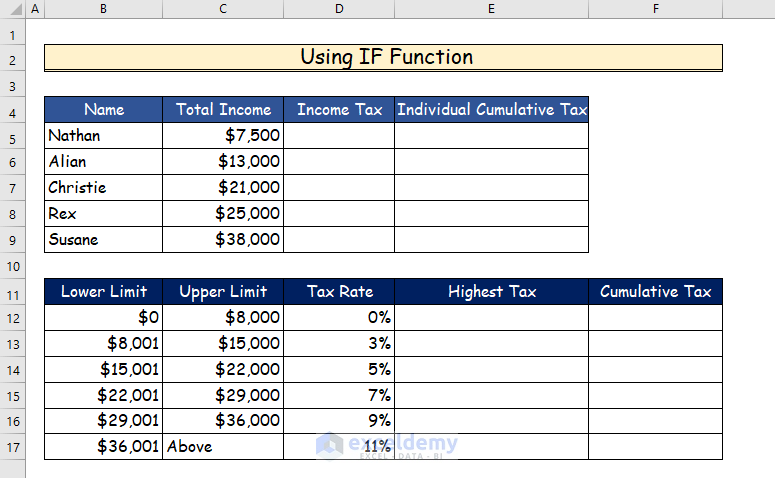

How To Calculate Income Tax In Excel

What Salary Makes You Eligible For Paying Income Tax In Malaysia Income Tax Salary Income

How To Calculate Foreigner S Income Tax In China China Admissions

How To File Your Taxes For The First Time

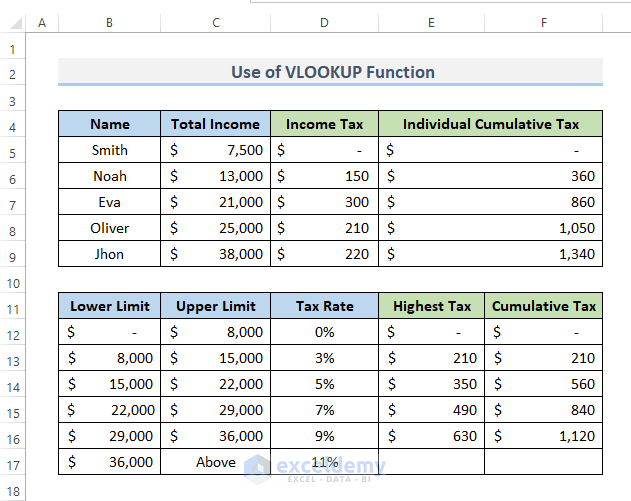

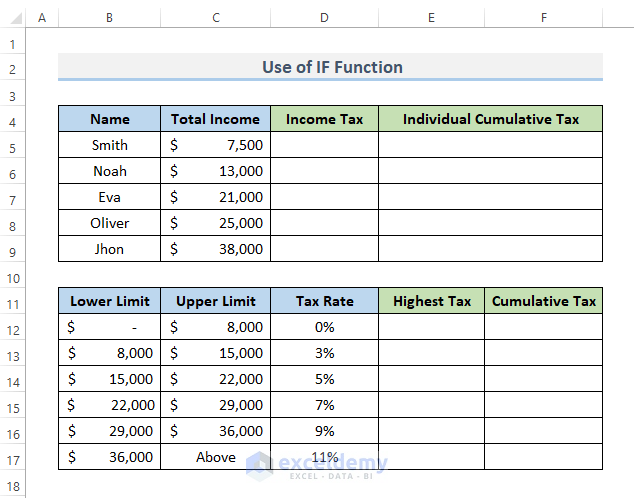

Income Tax Computation In Excel Format 4 Suitable Solutions

Computation Of Income Tax Format In Excel For Companies Exceldemy

How To Calculate Income Tax In Excel

What Is Local Income Tax Types States With Local Income Tax More

How To Step By Step Income Tax E Filing Guide Imoney

The Irs Made Me File A Paper Return Then Lost It

Computation Of Income Tax Format In Excel For Companies Exceldemy

Guide To Using Lhdn E Filing To File Your Income Tax

Income Tax Computation In Excel Format 4 Suitable Solutions

How To Calculate Income Tax In Excel

Corporate Income Tax Filing Obligations And Basis Of Assessment Youtube

How To Download Ais Statement From Income Tax Portal Eztax

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

No comments for "submit income tax malaysia"

Post a Comment